THL S Corp Business Tax Accelerator

The Strategic Tax Advantage for Small Business Owners

Tired of paying too much in taxes? Ready to run your business like a true CEO?

The THL S Corp Accelerator is your step-by-step guide to legally lowering your tax bill, protecting your profits, and unlocking long-term financial strategy — even if you’re not a numbers person.

What You’ll Learn...

Inside this self-paced accelerator, you’ll discover:

What an S Corporation really is — and how it compares to LLCs and sole proprietorships

When it makes sense to switch to an S Corp based on your income

How to pay yourself the smart (and legal) way with reasonable compensation

How to set up your books, track salary, and issue shareholder distributions

The power of Accountable Plans to reimburse yourself tax-free

What fringe benefits you can legally enjoy as a business owner

How to stay compliant and avoid IRS red flags

Advanced strategies like retirement planning, family hiring, and tax-efficient reinvestment

Who This Is For

This course is perfect for:

Entrepreneurs earning $40K+ in net profit

LLC owners ready to scale and keep more of what they earn

Service providers, consultants, coaches, real estate agents, and creatives

Business owners who want strategy, not guesswork

The Importance of Business Credit

What’s Included

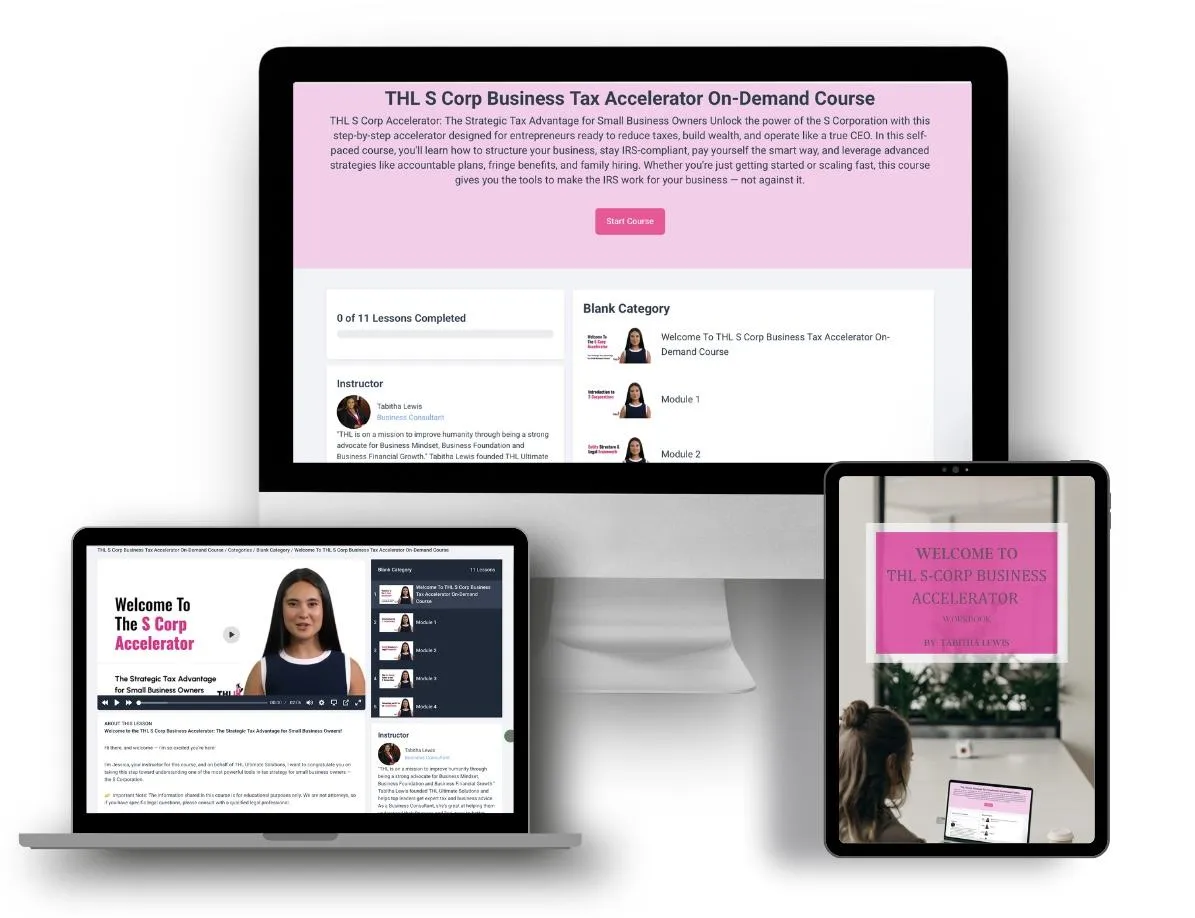

9 clear, easy-to-follow video modules

Downloadable workbook with key notes, templates, and checklists

Real-world examples and walkthroughs

Bonus templates: Accountable Plan Policy, Meeting Minutes, IRS forms

Lifetime access to all updates

Running your business under the wrong structure could be costing you thousands every year in unnecessary taxes. The S Corp Accelerator teaches you how to shift from “hustle mode” to “CEO mode” — and finally make the IRS work for your business, not against it.

Get Access Now!

Because of the digital nature of this course, there are no refunds. If you have issues with the course, please contact us at [email protected].

Meet Your Facilitator

Tabitha Lewis

Business Consultant

Tabitha Lewis founded THL Ultimate Solutions and helps top leaders get expert tax and business advice. As a Business Consultant, she's great at helping them understand their finances and find ways to better manage their money and improve their company's financial health.

She strives to enhance businesses' financial strength and health, emphasizing both long-term stability and swift tax solutions. Her education includes an Associate degree in Psychology, a Bachelor's in Business Management, and a Master’s in Business Administration with a focus on Project Management, all from the University of Phoenix. This diverse education helps her handle complex business issues effectively.

Tabitha also has deep experience in taxes as an IRS Tax Professional. Her wide-ranging knowledge and eagerness to help make her a key leader in her community. She is committed to teaching effective tax and profit strategies, making sure her advice is tailored to her clients' and students' specific needs.